In the hallowed halls of the London School of Economics, Volodymyr Gubskyi’s passion for structured products was ignited during a seminar, setting the stage for a remarkable journey. With a career etched at the pinnacles of financial prowess—Merrill Lynch, RBS, and Deutsche Bank—Gubskyi honed his expertise in cross-asset derivatives, weaving a vision that would reshape the landscape of structured investments.

Their brainchild, IVM Markets, emerged from the crucible of experience and collaboration with Co-Founder Ildar Farkhshatov. The mission: to revolutionize structured product offerings through the magic of AI-driven software, creating a paradigm shift towards personalized investment solutions. “We wanted to make investing a personal journey, not an industrial process,” Gubskyi reflects. His tenure at major banks exposed the shortcomings of an industry shackled by repetitive, industrialized product issuance. Gubskyi envisioned a platform that would empower investors to sculpt their financial destinies.

Enter IVM Markets, an embodiment of innovation with a laser focus on democratizing the investment process. The platform leverages cutting-edge AI to tailor structured products to individual preferences, challenging the status quo of a market plagued by generic offerings.

A Visionary Response to Market Inefficiencies

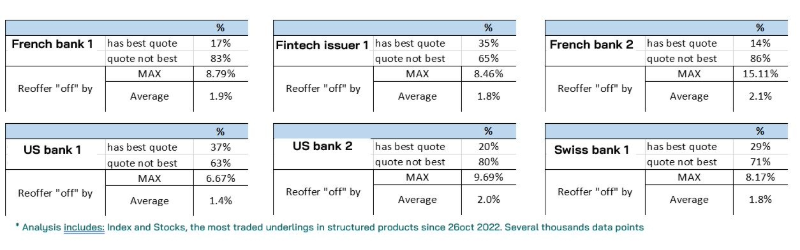

At the heart of Gubskyi’s mission is the resolve to combat the industry’s inefficiencies head-on. Reflecting on his experiences, he draws a parallel to the streamlined search and recommendation systems of e-commerce giants like Amazon and Netflix. In stark contrast, the structured products market lacked such efficiency. Cumbersome sales processes and manual trial-and-error methods were the norm, resulting in suboptimal outcomes for both banks and investors. “Recognizing this inefficiency, I founded IVM Markets with Ildar to address this gap, creating a platform that revolutionizes the way structured products are selected and personalized, streamlining the process for financial professionals,” shares Gubskyi.

Founded in 2018, IVM Markets stands as a testament to Gubskyi’s commitment to addressing the lack of personalization in structured product offerings. The company stands at the forefront of the finance industry, offering AI-driven solutions that empower financial institutions to design structured products tailored to individual investor needs. In doing so, IVM Markets breathes life into the concept of democratizing the market, ushering in a new era of tailored financial solutions.

Innovating the Future: IVM AI B2B SaaS Structured Product Suite

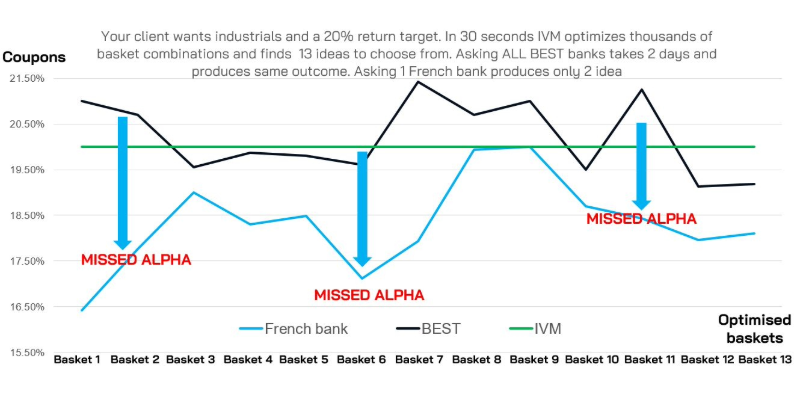

At the core of Gubskyi’s vision stands the IVM AI B2B SaaS Structured Product Suite, a groundbreaking and comprehensive solution poised to redefine the structured product landscape for financial institutions across the value chain. The IVM AI Suite streamlines the traditionally time-intensive process of idea generation for structured product distributors. Gubskyi envisions a future where the suite becomes an indispensable element in the toolkit of every financial institution, revolutionizing how ideas are conceived and presented.

“The Suite significantly reduces the time spent on generating and selling ideas by automating the selection of optimal structured products,” Gubskyi emphasizes. In a world where speed and precision are paramount, this automation not only boosts efficiency but also unlocks new realms of possibility in the structured product landscape.

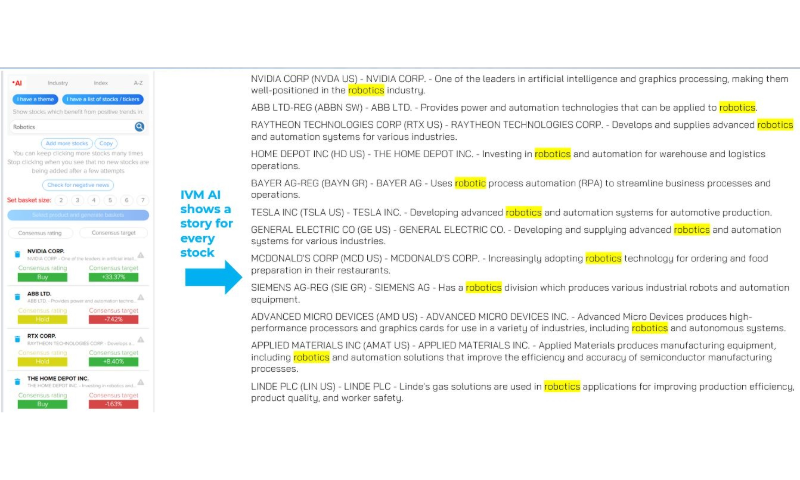

The true magic of the IVM AI Suite lies in its ability to transcend conventional boundaries. The AI engine generates thematic stock or Index/ETF lists, providing not just data but actionable insights. It doesn’t stop there—imagine a suite that not only suggests but also explains. Gubskyi’s brainchild offers explanations for stock or Index/ETF selections, bridging the gap between raw data and informed decision-making.

In a world inundated with information, the IVM AI Suite acts as a discerning guide. It curates analyst consensus and performs news checks, distilling the noise into valuable, actionable intelligence. Gubskyi envisions a future where financial professionals can rely on the suite not just for data but for curated insights that drive strategic decision-making.

The Suite is not just about generating ideas; it’s about turning those ideas into profitable realities. Gubskyi emphasizes, “It enables users to price thousands of product variations quickly, focusing on maximizing returns while minimizing risks.” In an era where agility is synonymous with success, the IVM AI Suite becomes the catalyst for efficient pricing and risk management, empowering financial institutions to navigate the dynamic landscape with confidence.

IVM’s commitment to inclusivity shines through in the suite’s design. Tailored for a diverse range of distributors, the white-label solution enhances revenue generation and decision-making efficiency across the board. Gubskyi’s vision encompasses not just innovation but accessibility—ensuring that financial institutions of all sizes can leverage the transformative power of the IVM AI B2B SaaS Structured Product Suite.

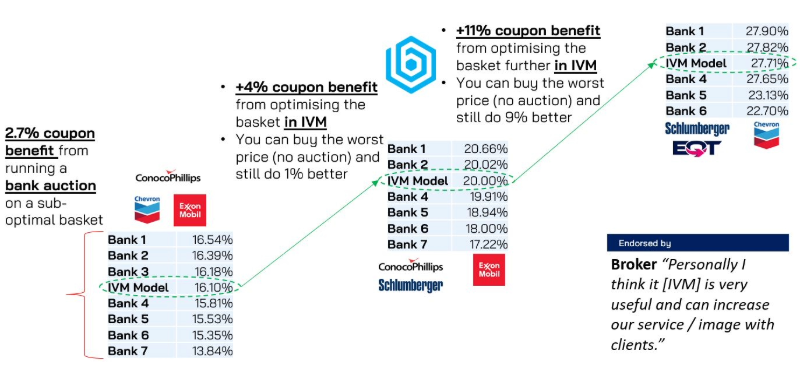

Creating Paradigm Shift in Structured Products

At the heart of IVM Markets’ philosophy lies a revolutionary concept—separating investment content generation from liquidity provision. This bold move transforms how the buy side engages with structured products, empowering them to generate unique investment ideas independently from the issuers. “Historically, the only place for a distributor to find an idea and get a price was within the investment bank that ultimately issued the structured product,” explains Gubskyi. With IVM, distributors can now design and optimize their desired products independently, approaching major investment banks solely for the final auction to secure the best price for their meticulously selected deal.

IVM Markets focuses on the crucial preliminary stages of designing and optimizing structured products, traditionally hindered by manual processes. By leveraging technology, clients can explore thousands of product variations, breaking free from the constraints of outdated methods. This shift is more than a process enhancement; it’s a seismic change that democratizes the structured product landscape.

“Our aim is to enable clients to explore a vast array of structured product variations, fostering a market where personalized investment strategies are not just a possibility but a reality,” affirms Gubskyi. In this liberated landscape, clients have the tools to tailor their investments to individual needs, ushering in a new era of financial empowerment.

Revolutionizing Power Dynamics: Distributors Take the Lead

IVM Markets envisions a future where the power dynamic between issuers and distributors undergoes a profound transformation. By providing technology that empowers distributors to independently generate investment content, the landscape shifts. Distributors, traditionally confined to the role of consumers, now become creators, owning the content creation piece of the chain.

“While big investment banks focus on ensuring that this content can be traded in the market, distributors take the lead in shaping the narrative,” Gubskyi declares. This shift results in a win-win scenario—the market witnesses more and better structured products being purchased by investment advisors from distributors and, in turn, from the investment bank issuers. The structured products market grows organically for all parties involved, marking a paradigm shift in the industry.

Transforming Financial Experiences through AI and B2B Innovation

In the ever-evolving landscape of financial services, IVM Markets stands at the forefront of change, revolutionizing the experience for wealth managers, asset managers, brokers, private banks, and insurance companies with its cutting-edge IVM SaaS Structured Product Suite. This powerful suite, seamlessly integrating AI and B2B elements, redefines how investment ideas are generated, optimized, and personalized.

At the core of IVM’s offering is a suite of AI-driven tools that empower financial professionals to rapidly generate personalized investment ideas. Whether you’re a wealth manager, asset manager, broker, private bank, or insurer, the suite’s capabilities cater to diverse financial needs. By curating thematic stock or Index/ETF lists and optimizing product variations, the technology adapts swiftly to client preferences and market conditions.

“Our goal is to ensure that wealth managers and other financial professionals can make high-return and secure investment choices with speed and precision,” emphasizes Gubskyi. This commitment to efficiency and adaptability positions the IVM SaaS Structured Product Suite as an invaluable asset in the arsenal of today’s financial professionals.

Client-Centric Approach: Empowering Clients with Control

IVM Markets spearheads a client-centric revolution in structured products and personalized investing. The AI-driven tools empower financial professionals to evaluate thousands of product variations rapidly, aligning seamlessly with clients’ specific preferences and market dynamics. This client-centric approach not only streamlines the investment process but also places more control in the hands of clients, fostering tailored and effective investment strategies.

“We believe that optimization in the preliminary stages of product design is pivotal in advancing the structured products market towards greater personalization and client empowerment,” asserts Gubskyi. The suite’s focus on these foundational stages sets the stage for a more responsive, adaptive, and client-focused financial landscape.

Digitalization Trends: A Glimpse into the Future

Gubskyi, a keen observer of emerging trends in finance, highlights the digitalization of equity structured products and the rise of multi-issuer platforms as key developments. Drawing parallels to the electronic trading transformation of FX derivatives, he notes the rapid growth of the equity structured products market in the US, echoing trends observed in Europe and Asia.

“The shift from manual to electronic trading in equity structured products mirrors what occurred in FX derivatives, emphasizing the need for personalization and differentiation in service offerings,” remarks Gubskyi. In this dynamic landscape, IVM’s software emerges as a vital catalyst, meeting the growing demand for solutions that navigate the changing dynamics of the financial industry.

A particularly exciting development noted by Gubskyi is the use of AI to analyze client portfolios and recommend relevant products. This showcases IVM’s commitment to leveraging technology for more personalized and efficient financial solutions. The integration of AI into the very fabric of financial decision-making reflects a forward-thinking approach that aligns with the evolving needs of the industry.

A Future Defined by Innovation

In the dynamic realm of finance, where change is the only constant, IVM Markets emerges as a trailblazer, shaping a future defined by innovation, efficiency, and client empowerment. The IVM SaaS Structured Product Suite, a harmonious blend of AI and B2B elements, stands as a testament to the transformative power of technology in financial services. By revolutionizing the way investment ideas are generated, optimized, and personalized, IVM Markets empowers wealth managers, asset managers, brokers, private banks, and insurance companies to navigate the complexities of the modern financial landscape with unparalleled speed and precision.

As Volodymyr Gubskyi aptly notes, the digitalization trends and the integration of AI into portfolio analysis signal a future where personalization, differentiation, and efficiency become paramount. IVM Markets, with its unwavering commitment to client-centricity and foresight into emerging trends, not only contributes to the evolution of structured products but also paves the way for a financial ecosystem where innovation is the compass guiding us towards new horizons. Stay tuned for the unfolding chapters of this financial revolution, where IVM Markets continues to redefine the very essence of financial experiences.

For More Info: https://ivmmarkets.com/