Ashish Gupta is an expert financial trader. He has worked in the IT industry for over a decade and has been trading for the last ten years actively. He quit his day job to pursue full time trading as a profession about four years ago and is primarily a delta-neutral volatility-based option trader. He also trades through his directional systems as well. Ashish has worked with some of the biggest IT corporates in the country such as IBM, Capgemini and Wipro. In the past 4 years of his full-time trading, he has generated about 40% CAGR trading very conservatively keeping maximum drawdown less than 7%. Ashish has done his B.Tech from MNNIT Allahabad and MBA from NITIE Mumbai.

Breakouts happen all the time and there are many ways to trade breakouts like buying equity or future, selling put or put spread, buying call or call spread. I am suggesting a rather different approach to trade breakouts that I have been trading for years to good benefit. When stocks are breaking out or are trading higher, the calls are in demand resulting in a skew on the call side (also known as reverse skew). The method relies on taking advantage of the rise in IVs and call side skew. There are a couple of options strategies that can be deployed –

- Sell bullish strangle – A short strangle is selling both an OTM put and an OTM call option. In case of a breakout, this method deploys a short strangle that has positive deltas making it a slight bullish trade to start with. Say a stock future is trading at 480 and it’s a breakout with rise in IVs, if we sell a 450 put option and a 530 call option, the trade would be positive delta. If stock continues to go higher/settles accompanied by IVs drop, the trade would benefit both from the starting positive deltas and the drop in volatility. If the stock reverses, it would again likely result in drop in volatility (unless it’s a sharp sell off) and the loss due to positive delta will get compensated by the drop in volatility. This method works well in most cases.

- Sell call ratios – In this option structure, we buy a call option with lesser IVs and sell a greater number of further OTM call options trading at much higher IVs due to call skew. It could be a 1:2 or 1:3 call ratio.

Let’s look at an example to better understand.

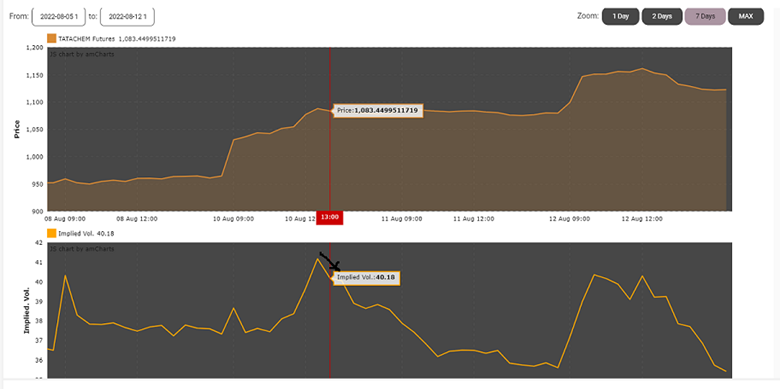

Tata Chemical – Tata Chemical recently posted stellar results on 8th of Aug and it opened with a gap up on 10th. Given below is the chart of Tata Chemical and as can be seen, it opened with a gap up of 7% and continued to go up even further.

Now let’s also look at the IV chart for that day. Since the stock opened gap up and continued to go up, IVs also shot up handsomely. From 38, it went up to 41-42. In this method of trading breakouts, one important thing to keep in mind is not short the rising IVs rather wait for either stock to settle or IVs to go down. As can be seen from the image, the IVs started coming down at around 1PM and that’s when the trade needed to be taken.

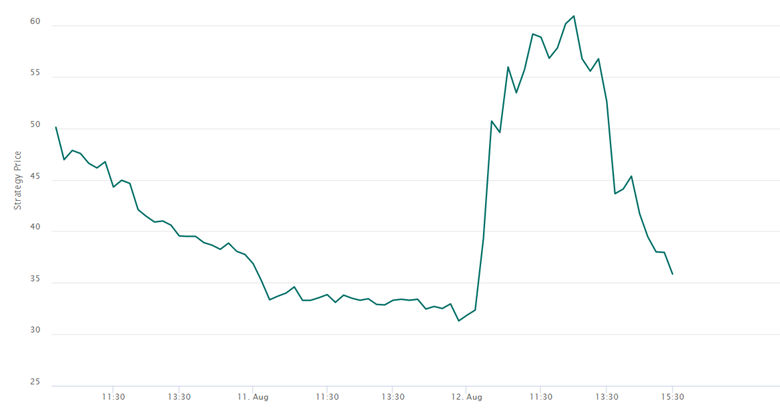

At 1PM, stock was trading at 1080, so if we have to short a bullish bias strangle, it could be to short sell 1060 put and 1120 call option. Here’s the chart of the combined price of this strangle. At 1 PM, it traded for 41 and closed at 37 at day end. What happened was that the stock didn’t react much after that and IVs crushed resulting in options pricing go down and a profitable trade.

Please understand this method won’t work in case if the breakout is too strong and stock keeps on going higher or if there’s a zigzag price action. So one must remember that not every trade makes money. A good trader must accept losses humbly. One can argue that I was playing for a breakout and yet got out at a loss despite the massive breakout, then what’s the point? The point is to take advantage of rising IVs/ skew on the call side. Not all breakouts are successful ones, some fail and some are slow. This method would result in profits in those cases. Most of the time, the trade makes money with or without adjustments but loses money in two cases — one when the rise is very strong and stock makes say 10%+ rise intraday with great momentum and two when there is a lot of zig-zag movement and adjustment costs kick in.

Note –

- As always, any setup is just that — setup. Trade management, position size and risk management are far more important than any setup. So, one should pay equal focus there if not more.

- Do not try to short the rising IVs on the first sign. Wait for either stock to settle down or the IVs to start sliding down.

- If trading multiple lots, start with 25–50% (depending on capital/lots to trade), add more only when trade starts to go in your favor. If the trade is not going in your favor, don’t add.

- If instead of our anticipated up move, stock tends to slide down, roll the call down just like we have to roll the puts up if the stock movement is very fast on the upside. Remember we have to keep delta in check and keep adjusting the trade.

- A few times, there will be a zig-zag movement and your adjustments will cost you. Remember not every trade will make you money so it’s best to accept loss on such trades. I have faced whipsaws many times and it’s best to cut out rather than firefight.

- Option selling comes with its own risk, so if you are not comfortable selling options and are already not doing it, this is best avoided.