April Tayson is Regional VP INSEA at Adjust. Based in Singapore, April is responsible for Adjust’s SEA sales operations, go-to-market strategy and growing the company’s market share and revenue. With over 15 years of experience in digital marketing, April is passionate about promoting Southeast Asia’s vibrant and fast-growing mobile ecosystem, while bringing more transparency and trust to the industry.

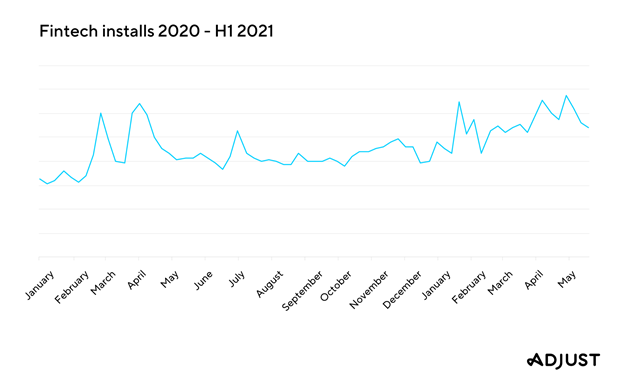

In 2020 we saw a huge shift in our app usage patterns and habits. The pronounced changes to our day-to-day led to an increase in how many apps we installed and how long we used them for. Fintech was a huge winner in this regard, seeing the largest increase across the board. Adjust’s Mobile App Trends 2021 Report found that app installs grew by 51% from 2019 to 2020, and are already up by another 23% so far this year.

According to Adobe’s Digital Trends Report, TSB Bank had to completely reshape their banking application process as they saw a massive increase in customers using online banking for the first time. The average mobile user has 2.5 finance apps installed – between the pandemic and wider exposure to personal finance, users are diversifying and exploring other finance management sources now more than ever. Adobe data show that toward the midpoint of 2020, a quarter of banking app downloads were digital banks in contrast with just 2% in 2017. These trends show no signs of slowing down as we move into the second half of 2021.

Playing Catch-Up

The digital finance trend is growing globally. China, India and Japan boasted significant increases in payment-app adoption, reaching highs of 81%, 3.6% and 25.4%, respectively. Even in markets like France and Germany, where mobile payments are traditionally not as popular, saw growth of 20%. With fintech reaching new heights the pressure is now on traditional financial service players to keep up.

More and more banks have either launched their own digital services and online user engagements or partnered with other fintechs. But just how effective is this transition and what can they learn from the disrupters in the financial sector? With our collective move to mobile there are industry standards we have become accustomed to. It’s up to legacy banks to adopt a mobile-first mentality to meet their users’ needs in order to stay competitive.

Adobe’s digital trends report uncovered that the top marketing priority is to enable customer acquisition (34%). A banking app should take a different approach to user acquisition (UA) than fintech apps that provide different services (e.g., investment, insurance). These subtle differences can then be capitalized on further to yield impressive results. Banks that target the right users for their services can depend on users’ loyalty and lifetime value (LTV). It’s all about focusing on their app’s function and unique selling points.

A Spotlight on User Journey and Experience

Over 45% of consumers in a survey by FIS stated that they’ve “permanently changed” how they do their banking since the pandemic, and 31% have also expressed interest in using more mobile banking apps in future. It’s clear that the traditional banks need to revamp their digital experience to be the ‘go-to’ for financial advice and provide assistance to their users for every step of their journey. The market is there — it’s time now for traditional banks to turn this new found interest into lasting trust.

By benchmarking fintech apps against the industry standards and expectations, marketers and developers for traditional banks can better understand, develop and tweak their strategies and their approaches to UA and retention. Pain points for legacy banks traditionally include onboarding and providing convenient service access around the clock. With mobile, we have unparalleled, instant access to just about everything— why not finance, too? Insights like these highlight the moments in which users could potentially churn, or drop off the app.

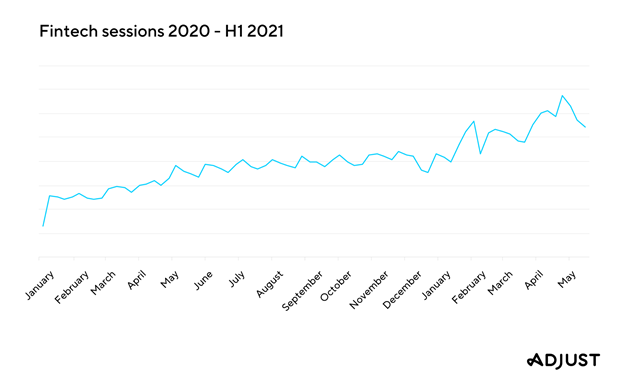

Data from Adjust’s global app trends report show that fintech app sessions grew by an impressive 85% year-over-year in 2020 — and they’re continuing to surge in 2021, reaching 49% growth already. Figures on overall session length show that banking increased from 4.95 minutes per session in 2019 to 5.5 minutes in 2020. As of H1 2021, this has decreased slightly to 5.2 minutes, but is still performing well above the 2019 average.

It’s no accident that user sessions are reaching brand new highs. Fintechs are constantly innovating and working on offering their users better experiences. As long as they can maintain this, they will continue to grow. User experience research and development is crucial for any legacy bank considering branching out digitally.

But success means developing a digital-only mindset, says Christopher Young, director of industry strategy and marketing, financial services, at Adobe.

“We work with some of the largest financial institutions that offer a range of digital and traditional channels. The discussions have been around shifting to a digital-first, but not digital only mindset. The reality is that they are competing with disruptive companies that are mobile ONLY. This needs to push the industry to focus more on the mobile experience and evolve it beyond purely transactional interactions.”

The Need for More Flexibility and Adaptability

Entirely mobile-first businesses offer their users increased control and better understanding of their money. In today’s finance landscape, customers can open a bank account and use their digital wallet in a matter of minutes. Rapid innovation via microservice architecture and APIs gives digital-first banks flexibility — and this is the kind of agility we expect as consumers. By contrast, legacy banking platforms are normally built on complex, stacked systems.

These systems are less agile than digital-first banking services, but, more importantly, far more costly to run. If legacy banks wish to compete with the banks shaping the finance industry, monitoring and adapting systems is crucial.

Understanding your users’ needs, expectations and in-app habits is more important than ever as digital banking continues to grow. Features like account fee plans, international purchases, instant payments, insightful interfaces and capabilities are the new norm. Legacy banks can look at these models to craft user-centric, data-driven strategies.

Adobe’s Young says it best: “Coming out of the pandemic, the focus of the financial services industry is to create more meaningful digital experiences that improve the financial health and well being of their customers. As mobile becomes the primary channel for customer interactions, the mobile experience needs to shift from money movement to helping consumers make smarter financial decisions.”

Opportunities to grow

By 2026, the global mobile banking market is expected to grow to $1.82 billion with a compound annual growth rate of 12.2% from 2019 to 2026. The time is now to analyze and learn from customers’ habits. From onboarding to user journeys and UX, insights and data points can be used to segment users and paint a clear picture of your company’s needs as customers adapt.

If you’re struggling with retention in your bank’s app, it’s time to start understanding how users are behaving in-app, when they’re returning and why. By putting a spotlight on your retention rates, you can troubleshoot onboarding issues, work out whether you’re providing enough fresh content to keep users engaged, and test the success of referral/onboarding offers. The banks that continuously innovate and offer better user experiences are those that will see the most success as markets around the world emerge from lockdowns.